Mr. Fathi Abu Farah explain to us the different benefits that the government offered in 2021/2022 like:

CWLB – Canada Worker Lockdown Benefit: Weekly benefit of $300 after-tax $270 for employed or self-employed but whose income was reduced by 50% due to lockdown

CRCB– Canada Recovery Caregiver Benefit: $450 per week up to 44 weeks, Anyone with children below 12 years old is extended until May 7th, 2022.

Employment Insurance: If you have ROE (Record of Employment) best to apply for employment insurance if there has been a lot of work/income.

Business Benefits / Supports Related to Covid-19

THRP– Tourism and Hospitality Recovery Program – reduction of revenue by 40 %

HHBRP– Hardest-hit Business Recovery Program – reduction of revenue by 50 %

Business Loan: Guaranteed from the Government apply through financial institution reduction in income more than 50 % reduction (loan is with interest) help bring up cash flow – $25, 000 – $1 000 000. 4 % interest up to 10 years in payments.

Ontario Grants: $20 000 – $40 000 tax-exempts any business that was closed, or the capacity reduced to 50% due to the pandemic. Businesses such as Banquet Halls, Convention Centres, Restaurants, Hotels, Gym.

My Account CRA Online Important to sign up for My Account on CRA. There you have access to all T4, T4A, T5 slips that are submitted to the government. You can also see your regular benefits such as GST, Childcare Tax Benefit, Ontario Trillium Benefit.

Attendees 34 members

Q & A

Not now, the benefits discussed today are for individuals who had income reduced either by work or their own business.

You can apply but may not be approved, it is for businesses with their place to let customers in and had to close their doors such as restaurants for dining. There is a wage subsidy for the wages of employees and a rent subsidy. So, it will be hard for them to approve if you are not rent a separate location from home.

For the Canada Lockdown Workers, Benefit CRA is insisting that you have made $5000.00 for the year, this is the rule and I have seen people have to pay back if they did not make the $5000.00 and received the benefit. However, you can apply for the caregiver benefit because in your case you had to stay home with your son and your income was reduced by 50%.

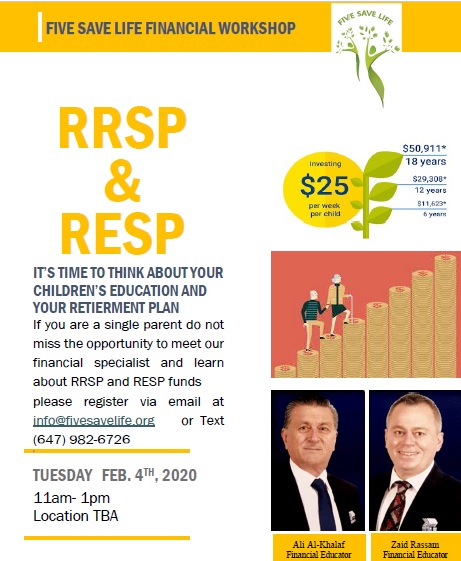

Mr. Khan – Banking Advisor at RBC and Mrs. Fatema- Financial planner were our speakers they explain the difference between RRSP, RESP, and TFSA

RRSP – Registered Retired Saving Plan

TFSF – Tax-Free Saving Account

RESP – Registered Education Saving Plans

Financial Planning Strategies

- Assessing your year-to-year spending needs

- Beware of tax implications and investment account withdrawals

- Regularly evaluate estate plan

RRSP

- the Main purpose of RRSP is to save for retirement

- Start with a small amount but start early

- Recommended to put money in RRSP if employed

- Taxable income reduces

- Building assets for your future

- Can withdraw money but you will be taxed on the amount this account is good for long-term saving

- Lower taxes

- Investment growth

TFSA

- No tax implications

- Money will grow in a small amount every year tax-free

- Can be used for mutual funds, stocks, or NFT

- Can be used to save for goals such as buying a home, a car, large purchases

RESP

- 2500 max per you will get 20% back

- Ex every $500 you will get back $100

- Recommended to have 1 account for all children if you have more than 1 dependant

- Canadian Education Bonds good for low-income families

RDSP

- Helping Canadians with disabilities with saving for retirement

- Once approved for ODSP

- Every dollar you put in the government will match with almost $3

How to be successful in saving:

- Start sooner than later

- Building a budget – record all money coming and all expenses going out

- Top up your contributions with tax refunds

Q & A:

Yes, this is preferable if you can contribute to both.

No, but the stress of additional cards can be worrisome and cause other issues. Banks will also see multiple lines of credit to you and may not approve you for a larger line of credit they may offer if you apply (bigger purchase such as purchasing a home or car loan).

No, this account can be opened for children preferably 6 years and younger. Government stops contributing to this account at the age of 17 years old. If you had an account in your name from you are a child and now an adult but did not use the money at that point it can be transferred into a Lifelong Learning Plan.

Try to use the money for another child and do not withdraw. If you cannot use it on another child, wait until the account matures, which will be when the account reaches 35 years old. At this point, the money can be transferred to an RRSP with no penalty.

Try to use the money for another child and do not withdraw. If you cannot use it on another child, wait until the account matures, which will be when the account reaches 35 years old. At this point, the money can be transferred to an RRSP with no penalty.

Depends on when you are looking to use the money or retire. If you are looking for long-term it is good to put money in a TFSA to help your money grow. If you are looking to use the money within 1- or 2-years money can be saved in GIC.

This may be a government grant or bond available to you. Sometimes incentives to open RESP are given out

You could think of having multiple accounts if you already opened and are concerned with fees. One question is if it’s too late or not? If the other institution has not opened the account or any contribution made, then it can be easily closed. If it has then it may be a process but I can be able to assist in transferring the account.

Resources:

https://www.canada.ca/en/employment-social-development/services/learning-bond/eligibility.html

https://www.canada.ca/en/employment-social-development/programs/designated-schools.html

Mr. Khan – Banking Advisor at RBC and Mrs. Fatema- Financial planner were our speakers they focus this session on the foundation of banking and how our clients can take advantage of all the services that RBC offers in the Urdu Language

To watch the workshop presentation click

Mrs. Alkayyali, Assistant Manager at RBC, Mr. Khan – Banking Advisor at RBC, and Mrs. Fatema- Financial planner were our speakers they focus on this session on the foundation of banking and how our clients can take advantage of all the services that RBC offers.

To see the workshop presentation click HERE.

Workshop Attendees 70

shorouq.alkayyali@rbc.com

humza.khan@rbc.com

Ph# (905) 712 8475

sadaf.fatima@rbc.com

Ph # (647) 830 2871

bassem.fawzy@rbc.com

The chartered accountant Fathi Abu Farah explain how to file CERB, CESB, and all the government support during the COVID19 era.

Over 30 participants attended the workshop and benefited from Mr. Abu Farah’s experience.

To watch the full workshop.

Workshop Attendees 38

Muslim Will founder Mr. Obaid explain the benefit of writing a will in Canada and how that will protect our clients’ children. He answered to many questions and offered a discount code FiveSaveLife20To watch the full workshop click below.

Workshop Attendees 22

We highlight the government and non government benefits and offers via this workshop. And if you would like to watch the full workshop click the below button.

Workshop Attendees 12

The financial advisors explain to our clients the benefit of RRSP and RESP and offer their expertise to help our clients to open new accounts and to plan the future of themselves and their children.

Workshop Attendees 10